Upon his inauguration, President Obama had to address a U.S. economy on the brink of disaster from the Bush/GOP tax cuts and banking deregulation.

And later, after the Wall Street bailout, McConnell and the GOP blocked help for ‘Main Street’. The following is an excerpt from the Nevada Appeal news, December 9, 2009:

The perception that the program mainly bailed out Wall Street bankers while doing little to help ordinary Americans has fed anti-Washington sentiment across the nation.

In clear acknowledgment of this sentiment, Obama said the unexpected $200 billion in repaid loans and other savings "gives us a chance to pay down the deficit faster than we thought possible and to shift funds that would have gone to help the banks on Wall Street to help create jobs on Main Street."

But Republicans cried foul, claiming that the leftover and repaid TARP money must be used exclusively for deficit reduction or additional bank bailouts, as the law setting it up spells out, and not for what amounts to an expensive new stimulus program to create jobs.

"The stimulus money clearly was a spending bill. TARP was a loan - a loan to be paid back. And we know that a number of the banks are, in fact, paying it back," said Senate Minority Leader Mitch McConnell, R-Ky. "So I don't think raiding a loan program to launch another spending spree is the best way to create jobs."

So while Wall Street bankers received a bailout from taxpayers, the economy was gravely weakened, millions of Americans were unemployed, and the GOP blocked any possible relief for average Americans.

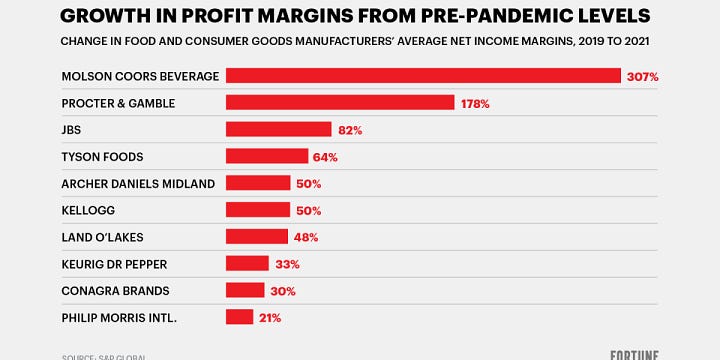

The Biden/Harris Administration inherited a mismanaged pandemic, $7 trillion dollars in new federal debt (from Trump/GOP tax cuts for corporations and the wealthiest Americans), collapsing supply chains, and a fragile global economy. The consumer price index rose nearly 7% from November 2020 through November 2021, and in 2022 over 9% due to rising global energy costs (and corporate greed).

During the Biden/Harris Administration, economic fundamentals have improved in the United States from the passing of the American Rescue Plan Act, The US ‘Bipartisan’ Infrastructure Law, the Inflation Reduction Act, and the CHIPS and Science Act.

Think of it like this. Three years ago a patient suffered a catastrophic health event. Blood pressure was dangerously high and volatile, temperature was elevated, blood oxygen levels were concerningly low. The patient felt horribly ill and didn’t look like they were going to make it.

President Biden and Vice-President Harris examined the patient. They immediately started an emergency treatment regimen. Over the course of treatment, the patient’s blood pressure stabilized and was now in an acceptable range. The respiratory system was clear and blood oxygen looked good. The patient’s temperature was now normal, and all the other vital signs had remarkably improved.

Yet the patient still feels horribly sick. This is the U.S. economy. And this is a massive problem as we accelerate toward the 2024 election cycle.

Consumer prices remain high. There are multiple factors at work. A significant issue in consumer pricing is the cost of energy. Moving a product from where it is grown, assembled or manufactured to a store shelf takes fossil fuels and/or other forms of energy. As energy prices increase (due to global supply issues, Putin’s war on Ukraine, artificial output constraints to prop up prices by Saudi Arabia, or fundamental greed by Big Oil -now raking in record profits), the cost of goods rise. Furthermore, most retail stores are fast at adjusting prices up to protect profit as underlying costs rise. However, when cost falls, they will only adjust prices downward if forced by competition.

The majority of Americans are living paycheck to paycheck. According to Bankrate’s Annual Emergency Fund Report, 68% of people are worried they wouldn’t be able to cover their living expenses for just one month if they lost their primary source of income. And when push comes to shove, the majority (57%) of U.S. adults are currently unable to afford a $1,000 emergency expense. This erodes consumer confidence, creates economic insecurity, and improving macroeconomic fundamentals means little to someone who has been struggling to get ahead since the banking crisis of 2007.

There is a sense of generational economic despair. Regardless of political ideology a (sane) parent wants to be able to provide for their child and family, and has an expectation that there will be more economic opportunity for the next generation to live a fulfilling life. According to analysis by Pew Research, “…since 2000, usual weekly wages have risen 3% (in real terms) among workers in the lowest tenth of the earnings distribution and 4.3% among the lowest quarter. But among people in the top tenth of the distribution, real wages have risen a cumulative 15.7%, to $2,112 a week – nearly five times the usual weekly earnings of the bottom tenth ($426).”

This means a significant part of the population has passed the work baton to the next generation with negligible gains in income while the cost of education and healthcare have skyrocketed. Knowing your children and grandchildren are going to have to endure far greater lifetime challenges due to catastrophic climate change, the proliferation of guns and gun violence, skyrocketing healthcare costs, the erosion of laws protecting Women’s rights, LGBTQ rights, and voter rights, and extreme wealth and income inequality leads to societal-level anxiety and despair.

People need relief now -not in the long run. While wages have stagnated and wealth inequality has been growing since the Reagan Administration slashed income and capital gains taxes for the wealthiest Americans, wages (compared to the cost of living) have stagnated for generations. People are working harder for less. The opportunities for the next generation have narrowed, while they are saddled with unprecedented student loan debt (more of the disastrous impact of the Reagan Administration). The frustration, anger, and despair are real.

While Rupert Murdoch and a handful of others have intentionally misdirected anger toward immigrants, deficit spending (seemingly not an issue when the Bush or Trump tax cuts were passed), climate action, or Social Security and Medicare -instead of the very real issue of income and wealth inequality, there is a significant and growing risk of a dystopian future for what will become a failed American experiment, with wealth and power so heavily concentrated there will no longer be any path toward representative democracy, economic fairness, or justice.

The Biden Administration must work to expand economic equity for the majority of working Americans, even if such legislation or policy fails in the GOP-extremist led House.

Carville needs to stop trashing Biden.